More options, less pressure: With inventory up 40.7% and months of supply nearly 50% higher, buyers have far more choices than last year. You’re less likely to face bidding wars and can be more selective.

Rates are easing: A 2.4% month-over-month drop in mortgage rates makes affordability slightly better. Locking in a rate now could secure long-term savings.

Negotiation power: Closings are down and homes are sitting longer (days on market up 14%), which gives you leverage to negotiate on price, seller-paid closing costs, or repair credits.

Act strategically: While prices are still inching up (+1% YoY), the market tilt favors buyers who move smartly and negotiate well.

Competition is growing: With inventory up significantly, you’ll need to price your home competitively and make it stand out (staging, curb appeal, professional photos).

Expect longer timelines: Homes are taking longer to sell, so plan accordingly and avoid overpricing.

Leverage buyer demand from lower rates: The recent dip in mortgage rates could bring more buyers back into the market—position your listing to capture that renewed demand.

Focus on value: Since prices are only up slightly, buyers will be looking closely at condition and pricing. Highlight updates, upgrades, or lifestyle benefits your home offers.

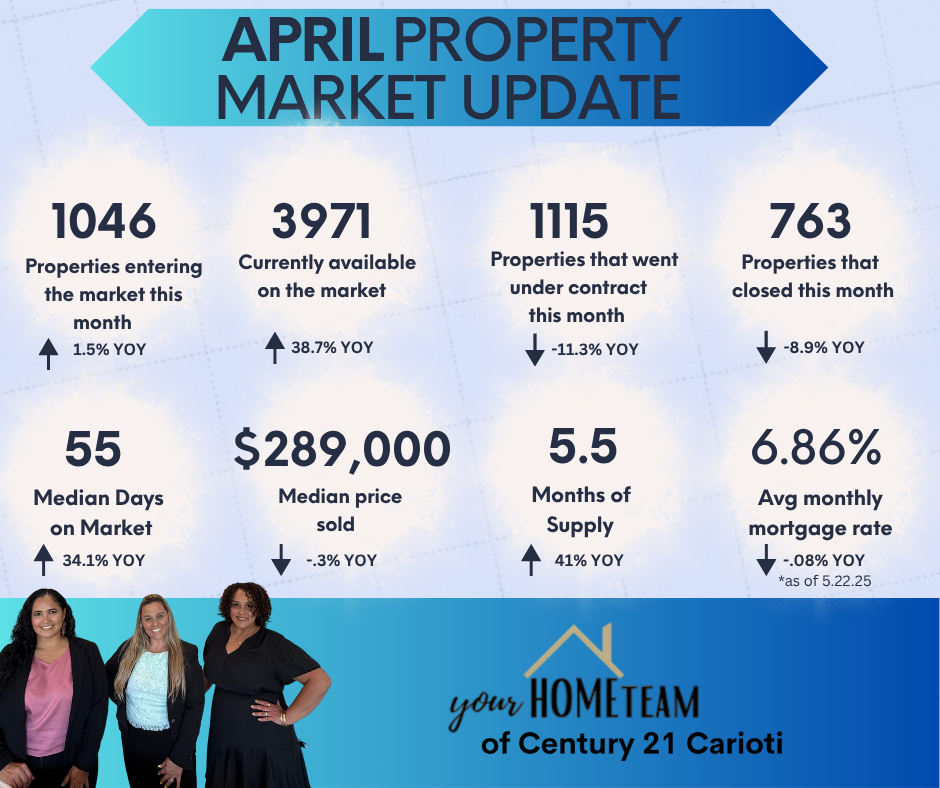

The Ocala market continues to evolve, offering distinct advantages for both buyers and sellers. In May, inventory climbed to 4,067 active listings, up a striking 40% year-over-year, while the median sales price rose modestly to $295,000—a 1.8% increase YOY. At 5.7 months of supply, Ocala is trending toward a more balanced market, giving buyers more room to negotiate while requiring sellers to be more strategic.

For buyers, increased inventory and a median 51 days on market mean greater selection and less urgency to overbid. However, with mortgage rates holding at 6.81%, it's essential to act decisively once you've found the right home. Leverage pre-approval, identify price-reduced opportunities and negotiate terms that protect your financial goals.

Sellers are facing a slower pace—contracts and closings are down double digits YOY, and more competition means it’s no longer enough to just list; you must position your property. Success now comes from professional marketing, competitive pricing, and standout presentation. Homes that show well and are priced right are still moving—and at near-peak values.

---------------------------------------------------------------------------------------------------------------------------------------

What do these stats mean for buyers and sellers???

Market Conditions Overview

We’re seeing clear signs of a cooling market:

More homes are being listed.

Homes are sitting longer.

Fewer are going under contract.

Overall supply is increasing, shifting us toward a more balanced or even a buyer-friendly market in some areas.

Price Strategically from the Start

Overpricing is riskier now than it was in a hot market. Buyers have more choices and are less willing to compete or bid up prices.

Homes priced right sell faster and closer to asking price, while overpriced homes often need price reductions and still sit.

Presentation Matters More Than Ever

Invest in professional photography, staging, and curb appeal. You’re competing against more listings, so your home must stand out.

Be Flexible and Responsive

Be open to negotiating repairs, closing costs, or even offering rate buydowns or incentives to appeal to today’s more cautious buyers.

Understand the "Cost of Waiting"

If you're also planning to buy, waiting to sell could mean higher holding costs or missing out on opportunities while the market adjusts further.

You Have More Leverage—Use It Wisely

With more inventory and longer days on market, buyers can negotiate better prices, request concessions, and avoid bidding wars in many cases.

Don't Wait for the "Perfect Bottom"

Trying to time the market perfectly is nearly impossible. Focus on buying when it’s right for your financial and personal goals, especially with more options and negotiating room available now.

Still Get Pre-Approved and Be Competitive

Sellers may be more flexible, but serious buyers still stand out. A strong pre-approval, clean offer, and reasonable terms can give you the edge, especially for well-maintained or uniquely desirable homes.

Watch Interest Rates Closely

If rates are volatile, talk with your lender about rate lock options. In a slower market, even small rate changes can impact your monthly affordability more than price shifts.

Markets are cyclical. We’re transitioning away from a hyper-seller's market, but that doesn’t mean doom or boom—it means strategy matters again!